|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

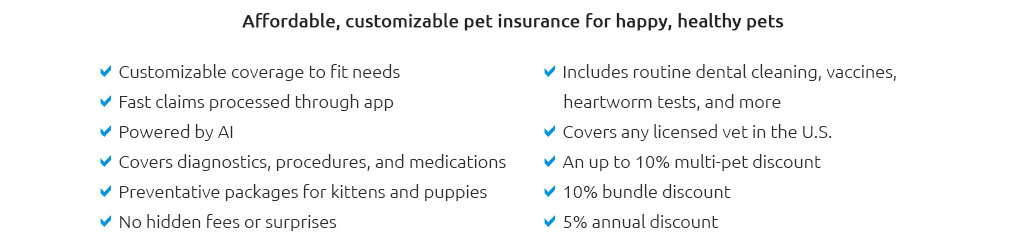

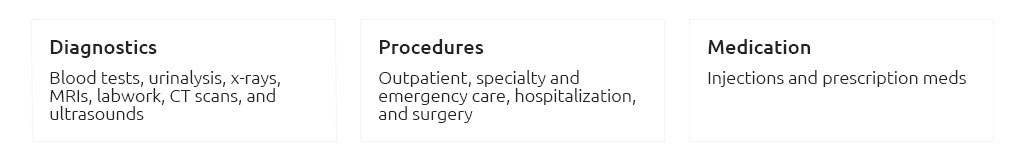

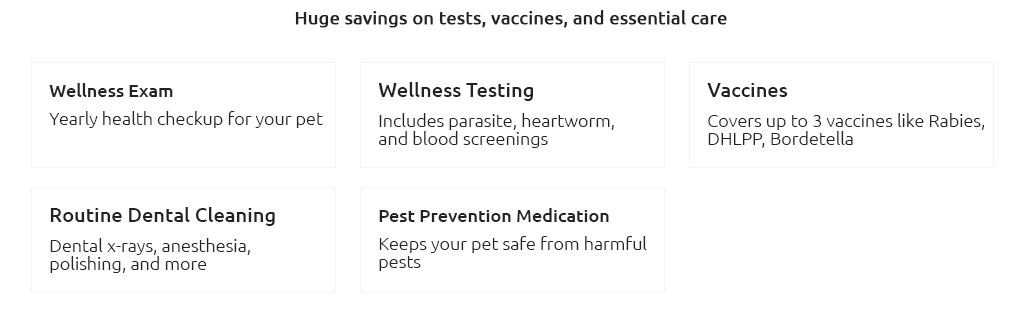

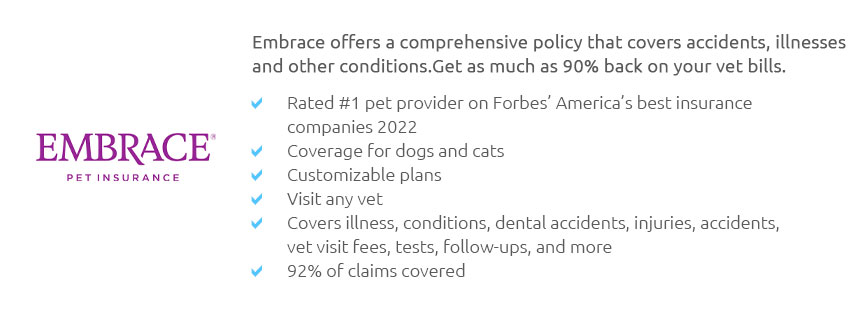

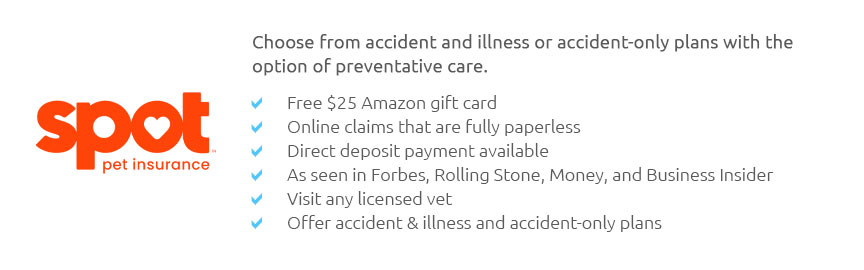

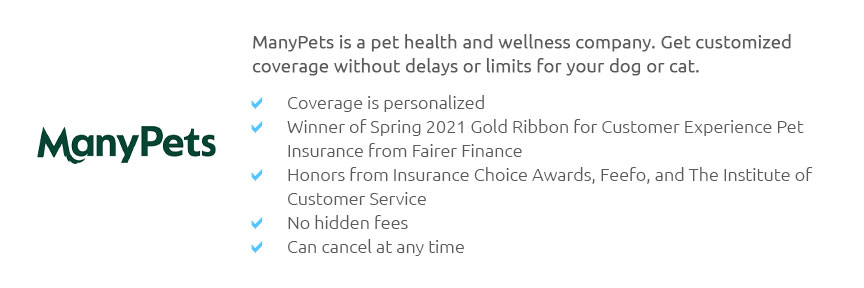

Understanding Pet Health Insurance in California: A Comprehensive Guide for BeginnersIn recent years, pet health insurance has emerged as an essential consideration for pet owners, particularly in California, where the cost of veterinary care can be significantly higher than in other parts of the country. As a responsible pet owner, understanding the nuances of pet health insurance can help you make informed decisions that ensure the well-being of your beloved animal companions. This guide aims to provide a comprehensive overview of pet health insurance in California, offering insights into its benefits, coverage options, and the factors to consider when choosing the right plan. Why Consider Pet Health Insurance? The primary benefit of pet health insurance is financial protection against unexpected veterinary expenses. Just like humans, pets can suffer from illnesses and injuries that require medical attention. Treatments for such conditions can be costly, often leading to difficult decisions about the level of care you can afford. Pet health insurance helps mitigate these costs, allowing you to focus on your pet's recovery without the added stress of financial burdens. Additionally, having insurance can encourage pet owners to seek preventative care, ultimately promoting better long-term health for their pets. Types of Coverage Available When exploring pet health insurance options in California, it's important to understand the different types of coverage available. Most insurance providers offer three primary types of plans: accident-only, accident and illness, and wellness plans. Accident-only plans cover costs associated with unexpected injuries, such as fractures or poisonings. Accident and illness plans, on the other hand, provide broader coverage, including treatments for illnesses like cancer or infections. Wellness plans, often available as add-ons, cover routine care, including vaccinations, dental cleanings, and annual check-ups. Each type of plan comes with its own set of benefits and limitations, so it's crucial to evaluate your pet's specific needs and lifestyle when making a decision. Factors to Consider When Choosing a Plan

The Importance of Research With numerous pet insurance providers operating in California, conducting thorough research is essential. Comparing plans, reading customer reviews, and seeking recommendations from fellow pet owners can provide valuable insights into the reliability and customer service quality of potential insurers. Additionally, consulting your veterinarian about the most common health issues for your pet's breed can help you select a plan that aligns with their specific health risks. In conclusion, while the decision to purchase pet health insurance ultimately depends on individual circumstances and preferences, being well-informed about the options and considerations involved can make the process more manageable. By investing in pet health insurance, California pet owners can gain peace of mind, knowing that they are better equipped to provide the best possible care for their furry family members. https://www.aflac.com/individuals/products/pet-insurance.aspx

If a pet gets sick or hurt, vet bills can add up. We work with Trupanion to offer medical insurance for pets. Get a medical insurance plan for your pet ... https://www.petco.com/shop/en/petcostore/insurance

Our most popular coverage starts at around $90/month for two dogs, which includes a 5% multi-pet discount. Two cats on our most popular plan would cost about ... https://www.insurance.ca.gov/01-consumers/105-type/8-pet/

Are you interested in purchasing insurance coverage that will help pay for veterinary expenses necessary for taking care of your pet?

|